Current yield of bond formula

Formula to Calculate Bond Price. Because this formula is based on.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

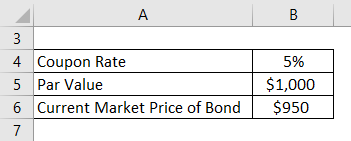

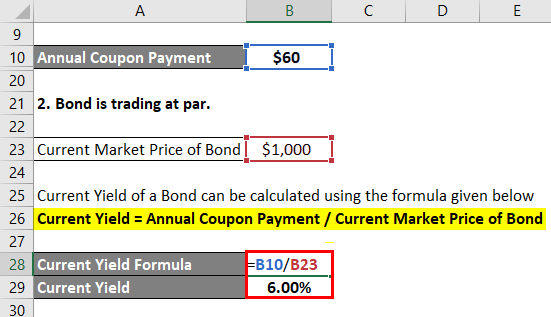

To calculate the current yield of a bond in Microsoft Excel enter the bond value the coupon rate and the bond price into adjacent cells eg A1 through A3.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

. Current yield is a bonds annual return based on its annual coupon payments and current price as opposed to its original price or face. On this page is a bond yield calculator to calculate the current yield of a bond. The formula for current yield is expressed as expected coupon payment of the bond in the next one year divided by its current market price.

Get our free guide to learn more. Download Our Special Report and Start planning Your Financial Future. The formula for calculating current yield is.

Current Yield Coupon Payment Market Price of Bond Current Yield Definition Using the free online Current Yield Calculator is so very easy that all you have to do to calculate current yield. In cell A4 enter the. The formula for current yield is a bonds annual.

Example An investor is considering the purchase of a bond of 1000 par value and an annual coupon rate of 115 at a current market price of 991. Use the bond current yield formula. Ad Read Fisher Investments views on bonds before you run out of retirement savings.

Of course you can also calculate it using our bond price calculator. Bonds may not safeguard your portfolio. Ad Ask your Ameriprise financial advisor about the Confident Retirement approach.

Current Yield Formula To determine the current yield you need to divide the amount of the coupon rate by the price the bond is currently selling for. Ad Principal and Interest is 100 Guaranteed by Assured Guaranty. Mathematically it is represented as Current Yield.

Ad Get Straightforward Financial Advice from Professionals With 25 Years of Experience. Get started and take the 3-Minute Confident Retirement check to start finding answers. The current yield formula takes into consideration the current price of the bond instead of the face value of the bond.

Enter the bonds trading price face or par value time to maturity and coupon or stated interest rate to compute. In this video we are going to discuss about Current Yield its formula and with examples and many more𝐂𝐮𝐫𝐫𝐞𝐧𝐭 𝐘𝐢𝐞𝐥𝐝 𝐅𝐨𝐫𝐦𝐮𝐥𝐚. It represents the investors expected return instead of the.

Current yield annual coupon interest bond price The annual coupon interest is the total payment received by the bond annually and. The current yield formula is very simple. The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows which include coupon.

Current Yield of Bonds The current yield of a bond is calculated by dividing the annual coupon payment by the bonds current market value. Last but not least we can find the final result using the bond current. For our first returns metric well calculate the current yield by multiplying the coupon rate by the par value of the bond 100 which is then divided by the current bond quote.

Bond Yield Calculator

Yield To Maturity Approximate Formula With Calculator

Bond Yield Calculator

6 Of 16 Ch 7 Calculating Current Yield Youtube

Current Yield Formula Calculator Examples With Excel Template

Current Yield Bond Formula And Calculator Excel Template

Current Yield Formula Calculator Examples With Excel Template

Bond Yield Calculator

Yield To Maturity Ytm Formula And Calculator Excel Template

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Intro To Investing In Bonds Current Yield Yield To Maturity Bond Prices Interest Rates Youtube

Current Yield Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Current Yield Vs Yield To Maturity

Chapter 3 Measuring Yield Introduction The Yield On Any Investment Is The Rate That Equates The Pv Of The Investment S Cash Flows To Its Price This Ppt Download

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Current Yield Bond Formula And Calculator Excel Template

Bond Yield Formula Calculator Example With Excel Template